Friday, March 31, 2006

stock fall, cut your loses, stock loses

Yes, it's very important to stick to your guns -- in fact, more than ever. As discussed above, investors that've been utterly wiped out by stocks like Lucent, Enron and Worldcom probably wished they'd cut their losses at 10% when the companies were still "good companies." The good thing about having a 10% rule is that you never have to separate between fact and rumor -- since you protect yourself no matter what.

What Fundamentals

Actually, sitting on a pile of cash is more of an advantage going INTO a slowdown than coming out of one. Coming out of recession, those firms that used cash to expand during the downturn will fare best. Also, if you think a recovery is coming you'll want to be buying stocks in "cyclical" industries -- such as health care and bio. And you'll want to avoid stocks in consumer staples, such as groceries, drugs and consumer products.

Do you still believe in the rule that you should sell if your stocks fall 10%? With it being so hard to determine Fact from Rumor how can you be sure it's the right thing to do?

Matt Krantz: Absolutely -- in fact, more than ever. As discussed above, investors that've been utterly wiped out by stocks like Lucent, Enron and Worldcom probably wished they'd cut their losses at 10% when the companies were still "good companies." The good thing about having a 10% rule is that you never have to separate between fact and rumor -- since you protect yourself no matter what.

the question we get about stocks!

So here is our answer for you all!!

First of all, no stocks should be trusted automatically, and every investment hold some risk. No matter what you buy, you should monitor stocks on a weekly if not daily basis to make sure nothing material has changed.

With that said, there are ways to find stocks that might fit your needs. A great place to start is by visiting yahoo finance/ and using the site's screening products. Look for companies with return on equity over the past five years of at least 15% and those with five-year earnings per share growth of at least 12% and revenue growth during the period of at least 10%. If you find some stocks you'd like to learn more about please be willing to share with us!

Keep investing wisely!

Sunday, March 26, 2006

CPST

I've been given permission to post this under $4 stock, which

hopefully will be over 4 soon. This is a speculative stock.It moves on news and technicals, no earnings. Thursday AH this stock popped and I couldn't find out why till Friday when it was still making a move. Peter Worden evidently had

posted AH Thurs on the stock, and that's when I e-mailed Demi saying

take a look, "see any news" Couldn't find anything.......Anyway

here's a link to what got it moving, I believe.

some cpst news

This company has lot's in the fire right now that could get it

hopping, at anytime. The first thing that brought my attention to it

was sad to say "Cramer" But that has long since past. Walmart may

use these turbines in their "green" stores. The US gov't has

approved them as a supplier, known as GSA approval.CPST is the only

microturbine co. to be awared this approval, which is worth noting.

That doesn't mean the gov,t is buying from them at this time , just

that they have been approved. But the potential is there. Some of

their turbines have just recently been UL certified. The best thing

to do is look at their website and yahoo finance for the latest,

just too much to post here. This is an excerpt from RM's Michael

Soni, March 9,2006."I am currently focused on Capstone Turbine (CPST:Nasdaq -

commentary - research - Cramer's Take). It is the world's leading

producer of low-emission microturbine systems, which generate power

in a more efficient and environmentally-friendly manner.

Capstone recently unveiled, with FuelCell Energy (FCEL:Nasdaq -

commentary - research - Cramer's Take), a newly operational fuel

cell/microturbine hybrid energy system. The system boasted a 56%

efficiency rate for 800 continuous hours during initial testing, and

is slated to be installed at a hospital in Montana. These types of

products are ideal for commercial and industrial customers

interested in reducing energy costs.

Trading in Capstone has been very good, and volume has picked up

nicely. The stock went from around $1 in the summer of 2005 to

almost $6 in the fall of 2005. Volume and liquidity are very good,

with average volume around 2.6 million shares per day. The stock,

after correcting from $6, has been trending sideways from $3 to $4

since November 2005. Capstone is currently 78% undervalued based on

the Value Engine model and maintains an IBD rating of 23. This is a

rather low rating, but is a reflection of the past, and I believe

that earnings will catch up. The growth potential is strong and the

environment is ripe.

My expectation is that the stock will break out again very soon

based on a forming technical pattern called a pennant, which tends

to indicate higher prices. Keep an eye on the stock and look to take

a position on a break above $4. Capstone has exhibited explosive

growth, so expect it to move quickly when it does break out.

Maybe we could suggest a stop loss at $2.25.

Monday, March 20, 2006

Borrowing Money To Pay for Stocks

Borrowing Money To Pay for Stocks

"Margin" is borrowing money from your broker to buy a stock and using your investment as collateral. Investors generally use margin to increase their purchasing power so that they can own more stock without fully paying for it. But margin exposes investors to the potential for higher losses. Here's what you need to know about margin.

Understand How Margin Works

Let's say you buy a stock for $50 and the price of the stock rises to $75. If you bought the stock in a cash account and paid for it in full, you'll earn a 50 percent return on your investment. But if you bought the stock on margin – paying $25 in cash and borrowing $25 from your broker – you'll earn a 100 percent return on the money you invested. Of course, you'll still owe your firm $25 plus interest.

The downside to using margin is that if the stock price decreases, substantial losses can mount quickly. For example, let's say the stock you bought for $50 falls to $25. If you fully paid for the stock, you'll lose 50 percent of your money. But if you bought on margin, you'll lose 100 percent, and you still must come up with the interest you owe on the loan.

In volatile markets, investors who put up an initial margin payment for a stock may, from time to time, be required to provide additional cash if the price of the stock falls. Some investors have been shocked to find out that the brokerage firm has the right to sell their securities that were bought on margin – without any notification and potentially at a substantial loss to the investor. If your broker sells your stock after the price has plummeted, then you've lost out on the chance to recoup your losses if the market bounces back.

Recognize the Risks

Margin accounts can be very risky and they are not suitable for everyone. Before opening a margin account, you should fully understand that:

* You can lose more money than you have invested;

* You may have to deposit additional cash or securities in your account on short notice to cover market losses;

* You may be forced to sell some or all of your securities when falling stock prices reduce the value of your securities; and

* Your brokerage firm may sell some or all of your securities without consulting you to pay off the loan it made to you.

You can protect yourself by knowing how a margin account works and what happens if the price of the stock purchased on margin declines. Know that your firm charges you interest for borrowing money and how that will affect the total return on your investments. Be sure to ask your broker whether it makes sense for you to trade on margin in light of your financial resources, investment objectives, and tolerance for risk.

Read Your Margin Agreement

To open a margin account, your broker is required to obtain your signature. The agreement may be part of your account opening agreement or may be a separate agreement. The margin agreement states that you must abide by the rules of the Federal Reserve Board, the New York Stock Exchange, the National Association of Securities Dealers, Inc., and the firm where you have set up your margin account. Be sure to carefully review the agreement before you sign it.

As with most loans, the margin agreement explains the terms and conditions of the margin account. The agreement describes how the interest on the loan is calculated, how you are responsible for repaying the loan, and how the securities you purchase serve as collateral for the loan. Carefully review the agreement to determine what notice, if any, your firm must give you before selling your securities to collect the money you have borrowed.

Know the Margin Rules

The Federal Reserve Board and many self-regulatory organizations (SROs), such as the NYSE and NASD, have rules that govern margin trading. Brokerage firms can establish their own requirements as long as they are at least as restrictive as the Federal Reserve Board and SRO rules. Here are some of the key rules you should know:

Before You Trade – Minimum Margin

Before trading on margin, the NYSE and NASD, for example, require you to deposit with your brokerage firm a minimum of $2,000 or 100 percent of the purchase price, whichever is less. This is known as the "minimum margin." Some firms may require you to deposit more than $2,000.

Amount You Can Borrow – Initial Margin

According to Regulation T of the Federal Reserve Board, you may borrow up to 50 percent of the purchase price of securities that can be purchased on margin. This is known as the "initial margin." Some firms require you to deposit more than 50 percent of the purchase price. Also be aware that not all securities can be purchased on margin.

Amount You Need After You Trade – Maintenance Margin

After you buy stock on margin, the NYSE and NASD require you to keep a minimum amount of equity in your margin account. The equity in your account is the value of your securities less how much you owe to your brokerage firm. The rules require you to have at least 25 percent of the total market value of the securities in your margin account at all times. The 25 percent is called the "maintenance requirement." In fact, many brokerage firms have higher maintenance requirements, typically between 30 to 40 percent, and sometimes higher depending on the type of stock purchased.

Here's an example of how maintenance requirements work. Let's say you purchase $16,000 worth of securities by borrowing $8,000 from your firm and paying $8,000 in cash or securities. If the market value of the securities drops to $12,000, the equity in your account will fall to $4,000 ($12,000 - $8,000 = $4,000). If your firm has a 25 percent maintenance requirement, you must have $3,000 in equity in your account (25 percent of $12,000 = $3,000). In this case, you do have enough equity because the $4,000 in equity in your account is greater than the $3,000 maintenance requirement.

But if your firm has a maintenance requirement of 40 percent, you would not have enough equity. The firm would require you to have $4,800 in equity (40 percent of $12,000 = $4,800). Your $4,000 in equity is less than the firm's $4,800 maintenance requirement. As a result, the firm may issue you a "margin call," since the equity in your account has fallen $800 below the firm's maintenance requirement.

Understand Margin Calls – You Can Lose Your Money Fast and With No Notice

If your account falls below the firm's maintenance requirement, your firm generally will make a margin call to ask you to deposit more cash or securities into your account. If you are unable to meet the margin call, your firm will sell your securities to increase the equity in your account up to or above the firm's maintenance requirement.

Always remember that your broker may not be required to make a margin call or otherwise tell you that your account has fallen below the firm's maintenance requirement. Your broker may be able to sell your securities at any time without consulting you first. Under most margin agreements, even if your firm offers to give you time to increase the equity in your account, it can sell your securities without waiting for you to meet the margin call.

Ask Yourself These Key Questions

*

Do you know that margin accounts involve a great deal more risk than cash accounts where you fully pay for the securities you purchase? Are you aware you may lose more than the amount of money you initially invested when buying on margin? Can you afford to lose more money than the amount you have invested?

*

Did you take the time to read the margin agreement? Did you ask your broker questions about how a margin account works and whether it's appropriate for you to trade on margin? Did your broker explain the terms and conditions of the margin agreement?

*

Are you aware of the costs you will be charged on money you borrow from your firm and how these costs affect your overall return?

*

Are you aware that your brokerage firm can sell your securities without notice to you when you don't have sufficient equity in your margin account?

Investors, please take note

If you keep good records, you’re more likely to prevail in a dispute with your broker. So say state securities regulators who have come up with a handy checklist for investors to fill in while they’re on the phone with their financial professional. The checklist takes minutes to complete, but could help to save a lot of grief and money.

The checklist prompts investors to record information such as the date of the broker’s call, the nature of the investment, how it was described to them, the broker’s name and their CRD number.

The CRD number corresponds to the broker’s record in the Central Registration Depository, a computer database jointly owned by state regulators and NASD. Investors should always check the CRD to see if the broker and their firm are registered in the investor’s state and to determine what, if any, disciplinary history they may have with regulators. To check a broker’s CRD record, investors can call their state regulator or the NASD’s public disclosure hotline at 800-289-9999.

Investors who keep good records of their dealings with their brokers have a leg up in any dispute. While the vast majority of brokers are honest, hard-working professionals, disputes do arise. Plus the kinds of questions the checklist prompts you to ask--like, ‘What’s your CRD number?’--could scare away some of the unscrupulous or dishonest brokers. The money you invest represents your financial future, so you need to keep close track of it.

What You Need to Know About Trading in fast moving markets

What You Need to Know About Trading

In Fast-Moving Markets

The price of some stocks, especially recent "hot" IPOs and high tech stocks, can soar and drop suddenly. In these fast markets when many investors want to trade at the same time and prices change quickly, delays can develop across the board. Executions and confirmations slow down, while reports of prices lag behind actual prices. In these markets, investors can suffer unexpected losses very quickly.

Investors trading over the Internet or online, who are used to instant access to their accounts and near instantaneous executions of their trades, especially need to understand how they can protect themselves in fast-moving markets.

You can limit your losses in fast-moving markets if you

* know what you are buying and the risks of your investment; and

* know how trading changes during fast markets and take additional steps to guard against the typical problems investors face in these markets.

Online trading is quick and easy, online investing takes time

With a click of mouse, you can buy and sell stocks from more than 100 online brokers offering executions as low as $5 per transaction. Although online trading saves investors time and money, it does not take the homework out of making investment decisions. You may be able to make a trade in a nanosecond, but making wise investment decisions takes time. Before you trade, know why you are buying or selling, and the risk of your investment.

Set your price limits on fast-moving stocks: market orders vs. limit orders

To avoid buying or selling a stock at a price higher or lower than you wanted, you need to place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. When you place a market order, you can't control the price at which your order will be filled.

For example, if you want to buy the stock of a "hot" IPO that was initially offered at $9, but don't want to end up paying more than $20 for the stock, you can place a limit order to buy the stock at any price up to $20. By entering a limit order rather than a market order, you will not be caught buying the stock at $90 and then suffering immediate losses as the stock drops later in the day or the weeks ahead.

Remember that your limit order may never be executed because the market price may quickly surpass your limit before your order can be filled. But by using a limit order you also protect yourself from buying the stock at too high a price.

Online trading is not always instantaneous

Investors may find that technological "choke points" can slow or prevent their orders from reaching an online firm. For example, problems can occur where:

* an investor's modem, computer, or Internet Service Provider is slow or faulty;

* a broker-dealer has inadequate hardware or its Internet Service Provider is slow or delayed; or

* traffic on the Internet is heavy, slowing down overall usage.

A capacity problem or limitation at any of these choke points can cause a delay or failure in an investor's attempt to access an online firm's automated trading system.

Know your options for placing a trade if you are unable to access your account online

Most online trading firms offer alternatives for placing trades. These alternatives may include touch-tone telephone trades, faxing your order, or doing it the low-tech way--talking to a broker over the phone. Make sure you know whether using these different options may increase your costs. And remember, if you experience delays getting online, you may experience similar delays when you turn to one of these alternatives.

If you place an order, don't assume it didn't go through

Some investors have mistakenly assumed that their orders have not been executed and place another order. They end up either owning twice as much stock as they could afford or wanted, or with sell orders, selling stock they do not own. Talk with your firm about how you should handle a situation where you are unsure if your original order was executed.

If you cancel an order, make sure the cancellation worked before placing another trade

When you cancel an online trade, it is important to make sure that your original transaction was not executed. Although you may receive an electronic receipt for the cancellation, don't assume that that means the trade was canceled. Orders can only be canceled if they have not been executed. Ask your firm about how you should check to see if a cancellation order actually worked.

If you purchase a security in a cash account, you must pay for it before you can sell it

In a cash account, you must pay for the purchase of a stock before you sell it. If you buy and sell a stock before paying for it, you are freeriding, which violates the credit extension provisions of the Federal Reserve Board. If you freeride, your broker must "freeze" your account for 90 days. You can still trade during the freeze, but you must fully pay for any purchase on the date you trade while the freeze is in effect.

You can avoid the freeze if you fully pay for the stock within five days from the date of the purchase with funds that do not come from the sale of the stock. You can always ask your broker for an extension or waiver, but you may not get it.

If you trade on margin, your broker can sell your securities without giving you a margin call

Now is the time to reread your margin agreement and pay attention to the fine print. If your account has fallen below the firm's maintenance margin requirement, your broker has the legal right to sell your securities at any time without consulting you first.

Some investors have been rudely surprised that "margin calls" are a courtesy, not a requirement. Brokers are not required to make margin calls to their customers.

Even when your broker offers you time to put more cash or securities into your account to meet a margin call, the broker can act without waiting for you to meet the call. In a rapidly declining market your broker can sell your entire margin account at a substantial loss to you, because the securities in the account have declined in value.

No regulations require a trade to be executed within a certain time

There are no Securities and Exchange Commission regulations that require a trade to be executed within a set period of time. But if firms advertise their speed of execution, they must not exaggerate or fail to tell investors about the possibility of significant delays.

You Have Options for Directing Trades

If for any reason you want to direct your trade to a particular exchange, market maker, or ECN, you may be able to call your broker and ask him or her to do this. But some brokers may charge for that service. Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice.

SEC rules aimed at improving public disclosure of order execution and routing practices require all market centers that trade national market system securities to make monthly, electronic disclosures of basic information concerning their quality of executions on a stock-by-stock basis, including how market orders of various sizes are executed relative to the public quotes. These reports must also disclose information about effective spreads – the spreads actually paid by investors whose orders are routed to a particular market center. In addition, market centers must disclose the extent to which they provide executions at prices better than the public quotes to investors using limit orders.

These rules also require brokers that route orders on behalf of customers to disclose, on a quarterly basis, the identity of the market centers to which they route a significant percentage of their orders. In addition, brokers must respond to the requests of customers interested in learning where their individual orders were routed for execution during the previous six months.

With this information readily available, you can learn where and how your firm executes its customers' orders and what steps it takes to assure best execution. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices – or look for that information in your new account agreement. You can also write to your broker to find out the nature and source of any payment for order flow it may have received for a particular order.

If you're comparing firms, ask each how often it gets price improvement on customers' orders. And then consider that information in deciding with which firm you will do business.

Your Broker Has a Duty of “Best Execution”

Many firms use automated systems to handle the orders they receive from their customers. In deciding how to execute orders, your broker has a duty to seek the best execution that is reasonably available for its customers' orders. That means your broker must evaluate the orders it receives from all customers in the aggregate and periodically assess which competing markets, market makers, or ECNs offer the most favorable terms of execution.

The opportunity for "price improvement" – which is the opportunity, but not the guarantee, for an order to be executed at a better price than what is currently quoted publicly – is an important factor a broker should consider in executing its customers' orders. Other factors include the speed and the likelihood of execution.

Here's an example of how price improvement can work: Let's say you enter a market order to sell 500 shares of a stock. The current quote is $20. Your broker may be able to send your order to a market or a market maker where your order would have the possibility of getting a price better than $20. If your order is executed at $20.05, you would receive $10,025.00 for the sale of your stock – $25.00 more than if your broker had only been able to get the current quote for you.

Of course, the additional time it takes some markets to execute orders may result in your getting a worse price than the current quote – especially in a fast-moving market. So, your broker is required to consider whether there is a trade-off between providing its customers' orders with the possibility – but not the guarantee – of better prices and the extra time it may take to do so.

Trade Execution: what every investor should know about trading

Trade Execution:

What Every Investor Should Know

When you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. But where and how your order is executed can impact the overall costs of the transaction, including the price you pay for the stock. Here's what you should know about trade execution:

Trade Execution Isn’t Instantaneous

Many investors who trade through online brokerage accounts assume they have a direct connection to the securities markets. But they don't. When you push that enter key, your order is sent over the Internet to your broker—who in turn decides which market to send it to for execution. A similar process occurs when you call your broker to place a trade.

While trade execution is usually seamless and quick, it does take time. And prices can change quickly, especially in fast-moving markets. Because price quotes are only for a specific number of shares, investors may not always receive the price they saw on their screen or the price their broker quoted over the phone. By the time your order reaches the market, the price of the stock could be slightly – or very – different.

No SEC regulations require a trade to be executed within a set period of time. But if firms advertise their speed of execution, they must not exaggerate or fail to tell investors about the possibility of significant delays.

Your Broker Has Options for Executing Your Trade

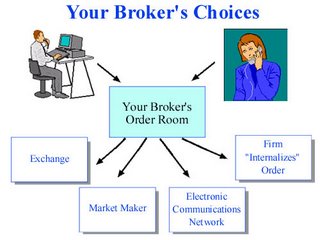

Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade:

* For a stock that is listed on an exchange, such as the New York Stock Exchange (NYSE), your broker may direct the order to that exchange, to another exchange (such as a regional exchange), or to a firm called a "third market maker." A "third market maker" is a firm that stands ready to buy or sell a stock listed on an exchange at publicly quoted prices. As a way to attract orders from brokers, some regional exchanges or third market makers will pay your broker for routing your order to that exchange or market maker—perhaps a penny or more per share for your order. This is called "payment for order flow."

* For a stock that trades in an over-the-counter (OTC) market, such as the Nasdaq, your broker may send the order to a "Nasdaq market maker" in the stock. Many Nasdaq market makers also pay brokers for order flow.

* Your broker may route your order – especially a "limit order" – to an electronic communications network (ECN) that automatically matches buy and sell orders at specified prices. A "limit order" is an order to buy or sell a stock at a specific price.

* Your broker may decide to send your order to another division of your broker's firm to be filled out of the firm's own inventory. This is called "internalization." In this way, your broker's firm may make money on the "spread" – which is the difference between the purchase price and the sale price.

Trade Execution Isn’t Instantaneous

Many investors who trade through online brokerage accounts assume they have a direct connection to the securities markets. But they don't. When you push that enter key, your order is sent over the Internet to your broker—who in turn decides which market to send it to for execution. A similar process occurs when you call your broker to place a trade.

While trade execution is usually seamless and quick, it does take time. And prices can change quickly, especially in fast-moving markets. Because price quotes are only for a specific number of shares, investors may not always receive the price they saw on their screen or the price their broker quoted over the phone. By the time your order reaches the market, the price of the stock could be slightly – or very – different.

No SEC regulations require a trade to be executed within a set period of time. But if firms advertise their speed of execution, they must not exaggerate or fail to tell investors about the possibility of significant delays.

Trade Execution: what every investor should know

What Every Investor Should Know

When you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. But where and how your order is executed can impact the overall costs of the transaction, including the price you pay for the stock. Here's what you should know about trade execution:

Day Trading: your dollar at risk

Your Dollars at Risk

Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses too.

While day trading is neither illegal nor is it unethical, it can be highly risky. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring.

Here are some of the facts that every investor should know about day trading:

*

Be prepared to suffer severe financial losses

Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading.

*

Day traders do not "invest"

Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. They want to ride the momentum of the stock and get out of the stock before it changes course. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses.

*

Day trading is an extremely stressful and expensive full-time job

Day traders must watch the market continuously during the day at their computer terminals. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. Any day trader should know up front how much they need to make to cover expenses and break even.

*

Day traders depend heavily on borrowing money or buying stocks on margin

Borrowing money to trade in stocks is always a risky business. Day trading strategies demand using the leverage of borrowed money to make profits. This is why many day traders lose all their money and may end up in debt as well. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads.

*

Don't believe claims of easy profits

Don't believe advertising claims that promise quick and sure profits from day trading. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance.

*

Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders

Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Once again, don't believe any claims that trumpet the easy profits of day trading. Check out these sources thoroughly and ask them if they have been paid to make their recommendations.

*

Remember that "educational" seminars, classes, and books about day trading may not be objective

Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading.

*

Check out day trading firms with your state securities regulator

Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at (202) 737-0900. NASAA also provides this information on its website at www.nasaa.org/QuickLinks/ContactYourRegulator.cfm.

Day Trading

Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. Day trading is extremely risky and can result in substantial financial losses in a very short period of time. If you are a day trader, or are thinking about day trading, read our publication, Day Trading: Your Dollars at Risk. We also have warnings and tips about online trading and day trading.

Under the rules of NYSE and NASD, customers who are deemed "pattern day traders" must have at least $25,000 in their accounts and can only trade in margin accounts. For more information, you can read the NASD's Notice to Members and the New York Stock Exchange's Information Memo.

The Connecticut Council on Problem Gambling has a quiz to help you decide if you are gambling in our markets and where to go for help.

Turtle Trading Explained

There are many websites offering courses in how to turtle trade, sometimes for thousands of dollars, some of them even run by people who are allegedly 'ex-turtles'. This is frankly hilarious - the entire turtle system is available for free as a PDF download from www.originalTurtles.org and we here at www.traders101.com STRONGLY advise you to grab it and read it before you lash out any cash on a 'course'. As far as we know, there is NOTHING to be learned from these expensive 'courses' that you can't find for free in the excellent download, written by real Turtle traders who were trained by the great man himself.

In order to help you decide whether turtle trading is for you, here's a quick overview. First off, in 1983 when Dennis tried the scheme, it worked. It worked BIG TIME in fact, producing an AVERAGE 80% compounded over the four years of the trial. The turtle trading rules themselves were simple - the secret was the ability to STICK TO THE RULES!. This made it a mechanical trading system par excellence, and a good mechanical trading system, as you should know, is the key to consistency.

The turtle trading rules specified in detail what markets to trade, how to size a position properly, when to enter and exit, how to use stops to exit a losing position, how to exit a winning position, and some ancillary tactics on the buying and selling of large positions without alerting the market.

What to trade. The turtles traded futures (commodities, as they were known at the time). They traded all liquid futures markets except grains and meats. That included T Bonds, coffee, sugar, cotton, currencies, precious metals and oils. An individual trader could decide what he wanted to trade.

Position Sizing. The turtles liked to normalize their positions based on the underlying dollar volatility of the market - a common trick nowadays, but advanced for the 80s. This made the effective risk across markets similar, and allowed them to trade many markets in a similar way. Key to this is 'N' - the underlying volatility of a market. To calculate N, find the 20 day exponential MA of the ATR (true range). There's a lot on Moving Averages over at www.traders101.com if you need a refresher. Having found N, the 'Dollar Volatility' is N x Dollars Per point. The S&P, for example, moves 50 bucks a point on the emini contract.

To create a turtle trading 'unit', you work out 1% of your equity, and divide by the dollar volatility. As you might have guessed, its a low risk strategy, as you need to be able to withstand extended drawdown periods to 'stay in the game'. The 'unit' tells you how many contracts to trade, and still stay relatively safe. To further de-risk the system, each market had limits. No more than 4 units could be traded in a single market, for example.

After losing trades, turtles would reduce the effective equity, in order to scale back risk even further. Expand when you are winning, pull back when you are losing. But how did they know when to trade???

Entries. There were 2 breakout systems used by the turtles. The first used a 20 day breakout. The second used a 55 day breakout. A 20 day breakout is where the high or low exceeds the high or low of the preceding 20 days. They took the trade when it was offered - i.e. this was not an 'end of day' system. If an opening gap caused the breakout, the turtles would still take the trade, as the idea was they would be in it for some days, and a couple of points at the start didn't matter. Personally, (and everyone at www.traders101.com agrees!) we never chase the gap. Obviously, the turtles traded both long and short. There were a couple of extra rules, such as ignoring a signal if the LAST breakout (whether the turtle took it or not) would have led to a winner. The 55 day breakout would then become the initiation point as a fail-safe on major moves. Full rules, are of course, available in the free download.

Stops. Turtle traders ALWAYS used stops. They defined the exit point BEFORE initiating a trade. Their positions could be so large that in order NOT to alert the market, 'mental' stops were used. No trade could carry more than 2% risk. This means a stop would be 2 x N away from the position.

Exits. Most breakouts do NOT result in trends. Most turtle trades, therefore, ended in losses. The winners therefore had to be BIG to cover the losers, and they were. The first exit rule was to exit on a 10 day low or high against your position. The second method was an exit against a 20 day high or low. Simple, yes. But at the time it worked. The HARD part for most traders is hanging on grimly as profits evaporate over 10 or 20 days! The cultivation of THAT discipline was the real secret!

Does it still work? Sometimes. The market is well aware of the legions of would-be turtles avidly watching for 20 day breakouts. 'Turtle Soup' is a common maneuver whereby a big player 'fakes' a move up or down to trigger the turtle signals, then reverses it, stopping them out. Mean, ain't it? Bottom line, if you want to turtle trade, you need to adapt the rules for your own personal style and hide your 'footprint' in the market.

About the Author

Trader Jack writes stock trading artices for www.traders101.com the free site helping traders get into profit fast

Monday, March 13, 2006

ETF Pros

bullet Some ETFs may have lower expense ratios than similar conventional index mutual funds. If true, this suggests that ongoing management fees would be lower, which favors ETFs. However, note that most ETFs have expense ratios which are not dramatically lower than the lowest cost conventional index mutual funds with similar investment goals.

bullet ETFs may be somewhat more tax efficient than similar conventional index mutual funds. This increased tax-efficiency is in the form of lower capital gains distributions (which effectively means that an ETF's capital gains tend to be more deferred than a similar mutual fund's would be). The idea that ETFs should have lower capital gains distributions comes from their ability to shed their lowest-basis shares to institutional arbitrageurs through in-kind redemptions. Note that this benefit applies to a much lesser extent to Vanguard's VIPER ETFs. Because they exist as a separate share class of conventional mutual funds, any tax benefit a VIPER ETF generates is shared by investors in the fund's non-ETF shares, thus diluting the beneficial effect for VIPER share owners.

bullet ETFs may have somewhat less "cash drag" than similar conventional mutual funds. Conventional mutual funds typically need to maintain a small amount of their portfolio in cash in order to meet ongoing cash redemptions. An ETF has no such need because it never has to deal with the possibility of cash redemptions. This may provide a slight advantage for ETFs over similar index mutual funds.

Note that if the ETF you are considering has a higher expense ratio than any similar conventional no-load index mutual fund AND the prospective ETF investment would not be in a taxable account (e.g., you are in an IRA), then ETFs will almost certainly underperform the alternative and you should abandon the idea of using the ETF in favor of the alternative.

Friday, March 10, 2006

ETF Cons vs. index mutual funds

ETF Cons...remember this is all etf cons vs. index mutual funds.

bullet When you buy or sell an ETF, you implicitly pay (as a "hidden" fee) one-half of the ETF's "bid-ask spread." Bid-ask spread is the difference in price between the market price for buying the ETF and the market price for selling the ETF. Note that, for a conventional no-load mutual fund, there is no bid-ask spread involved.

An ETF's bid-ask spread can be quite small (e.g., for domestic large-cap stock ETFs and Treasury Bond ETFs) or quite large (e.g., for emerging market ETFs). In our opinion, this is the factor which most makes it impractical to utilize ETFs. Bid-ask spreads make it impractical to hold ETFs for very short lengths of time (i.e., because it probably doesn't make sense to incur this implicit purchase/redemption fee very often).

However, even if an ETF has a large bid-ask spread, it is conceptually possible for it to outperform a similar conventional index mutual fund in the long run if (and only if) both of the following are true:

bullet The ETF has a lower expense ratio than the similar conventional index mutual fund.

bullet The ETF will be held long enough for the compounded benefit of the lower expense ratio to exceed the higher costs of the bid-ask spread.

bullet In order to buy or sell an ETF, you need to pay a brokerage commission. If you buy/sell through a discount broker, this might be on order of $10/trade (no such fees are typically needed to buy/sell a no-load mutual fund). This fact makes dollar-cost averaging small amounts into ETFs impractical. ETFs are most practical for deploying relatively large amounts of capital.

bullet The ETF may have somewhat higher internal transaction costs than a similar conventional index mutual fund. When the index that the ETF tracks changes, it must sell all shares of stocks leaving the index and buy enough shares of stocks entering the index. In order to buy enough of the replacement stock, it may need to sell shares of hundreds of other stocks — incurring significant trading expenses.

A conventional index mutual fund must also sell all shares of stocks leaving the index and buy shares of the replacement. However, it can do it as part of its ongoing cash-flow management process. If, for example, the fund has net purchases (i.e., net cash-flow into the fund), it has to buy some stocks with that money anyway — and this cash can be used to buy the new index component. Likewise, if the fund is experiencing net redemptions, it has to sell stocks anyway — and it can choose to generate liquidity by selling shares of the stock which left the index.

Note that this criticism does NOT apply to Vanguard's VIPER ETFs. They exist as separate share classes of conventional index mutual funds and are not subject to this adverse effect.

bullet ETFs won't track indexes as well as conventional index mutual funds. A mutual fund's share price is always, by definition, the fund's net asset value (NAV). The NAV is just the weighted-average current market value of all the fund's holdings, expressed on a per-share basis.

An ETF, on the other hand, is valued by the market. So even if its holdings are EXACTLY consistent with those of the index, its market price at any particular time can be either above or below the NAV (meaning it can be sold at either a higher or lower price than the per-share value of its underlying securities).

The difference between NAV and market price for an ETF won't ever be very high because institutional arbitrageurs are able to either create or redeem shares of the ETF using the underlying stocks. This tends to drive the ETF price back towards its NAV. However, this tracking error is likely to be higher for ETFs which hold less liquid securities (e.g., emerging markets stocks).

bullet ETFs have poor coverage of foreign style/size indexes. If you wanted to buy a foreign value ETF, for example, you would not be able to do so at present. There is a much greater selection of non-ETF foreign mutual funds covering the gamut of style and size combinations.

bullet There are few bond ETF options available at present. However, note that ETFs are less desirable for bonds anyway — since a relatively small portion of a bond's total return is due to capital gains, the tax efficiency benefit of bond ETFs is relatively trivial.

bullet If the ETF is organized as a Unit Investment Trust (e.g., the SPDR ETFs), then all dividends the fund receives are required to be held in a non-interest bearing account until distributed to investors. This causes a "cash-drag" on the fund's earnings which conventional index mutual funds (and non-UIT ETFs) don't experience.

bullet Most people choose to have distributions of conventional mutual funds automatically reinvested in additional shares of the fund. This is convenient — it keeps your money working for you without requiring extra effort on your part to redeploy the distributions.

On the other hand, ETFs don't have this as an alternative. They pay out distributions as cash. If you want to then reinvest that cash, you need to take some action to do so (and incur whatever transaction costs apply).

bullet Apparently, you can only buy/sell ETFs in whole share lots. In other words, while you can buy exactly $5,849.23 of some mutual fund, you can't necessarily buy that much in an ETF — you have to buy whole shares (not fractional shares). This isn't a big deal, you just have a bit less flexibility and there may be a little more "cash-drag" in your account if you use ETFs instead of mutual funds. But then again, ETFs tend to hold lesser amounts of cash themselves (since they don't have to keep cash on hand to meet cash redemptions, as do mutual funds).

Overall, there are few pros and many cons to using ETFs. However, for certain situations, there are low-cost ETFs which may make sense.

especial thanks to Altruist Financial Advisors LLC

Thursday, March 09, 2006

This is the new question etf, etf investing, etf portfolios

Exchange Traded Funds (etf) have recently become somewhat popular. What are etf, etf investing...well to be simple, they are basically just index mutual funds which are bought and sold as stocks. In that way, they are similar to closed-end mutual funds which happen to be index funds. However, they have several interesting features which make them more similar to conventional (open-end) index mutual funds.

An obvious question is, "Which should I use, etf investing or conventional index mutual funds?"

We have it all here yet to come etf, etf investing, and etf portfolios pro and cons serious coming soon!!!

Friday, March 03, 2006

How to Maximize Your 401k Mutual Fund Returns

How to Maximize Your 401k Mutual Fund Returns

By: Ulli G. Niemann

When it comes to 401k's there is an overabundance of sad stories. Here is one that at least has a happy ending—and it's getting happier all the time.

Last year (in 2002) a friend of mine—let’s call him Jack—phoned and asked if I could help him with his 401k. Jack works for a large company as Senior VP of lending and is financially pretty astute. However, when it came to his 401k mutual fund decisions, he had repeatedly made the same mistake most people were making. As a result, he saw his account drop in value substantially.

At the time we were in the midst of the 2000 bear market, which showed no sign of letting up. Jack had purchased into a Lifestyle fund because someone recommended it. By the time he finally bailed out, it cost him dearly. However, he continued to make the same mistake by reinvesting.

He checked with the 401k representative and subsequently switched to a variety of mutual funds ranging from World Stock to Domestic Hybrids, Large and Small Value as well as Growth. But nothing worked and his portfolio value headed further south.

By the time we met to discuss his 401k Jack was pretty disgusted by the canned advice he had received and the continued losses he was sustaining.

Jack knew that I had pretty much eluded the bear market of 2000 by having sold all of my clients’ positions on 10/13/2000. We were safely in our money market accounts weathering out the storm (see my article "How we eluded the bear in 2000."

Thinking about this, Jack could only shake his head because at no point in the market slide had he ever been given what I believe was the right advice. That is, no one suggested that, since we were in a bear market, he might want to step aside and remain in the safety of his money market account. So he stayed invested, hoping against the evidence all around him to find something that was not crashing. That was his mistake, and one shared by many.

The advice that he consistently and continually received was that the market was close to a bottom, stocks “have to” move up from these levels, and, my personal money losing favorite, “the market can’t go any lower.” That's what people wanted to hear and believe. But my tracking system said otherwise, and I followed its indicators—much to the delight of my clients.

Jack wanted to know how I could help. Looking at his mutual fund choices I realized that they were actually pretty decent, and he had a variety of some 13 funds. So, what was the problem and how could we solve it? In a way, the answer was simple. But people were having to get pretty beat up before they would see it.

My first step was, with Jack's permission, to log on to his 401k web site. Then I started making some adjustments. Since my trend tracking model was still in a Sell mode, I liquidated all of his positions and moved the proceeds into money market. This accomplished one thing right away: He stopped losing money. When you stop moving backward, in relation to everyone else you are moving forward!

Second, as my trend index moved into a Buy mode on April 29, 2003, I researched his funds again. Based on strong momentum figures, I invested in two of his mutual fund choices. The result was very gratifying: the funds I chose moved up around 10% in the two months after my Buy. (Other funds I had tracked and selected for other types of investment programs moved up as much as 26% in that period.)

Jack’s been happy ever since. While the 10% appreciation is not as great as I was able to do with assets outside his 401k, it still confirms that the key to successful investing is methodology and discipline. Our disciplined approach relies on objective information. It disregards Wall Street hype designed to perpetuate commission-rich buy now while it's low, or buy and hold strategies.

If you have been in a situation similar to Jack's, or you want to avoid being in one, find an investment advisor who bases his decisions on a measured and objective approach. That will give you the edge no matter whether the market is going up or down and will give you the greatest protection from sad stories with your 401k.

About the Author

Ulli Niemann is an investment advisor and has been writing about objective, methodical approaches to investing for over 10 years. He eluded the bear market of 2000 and has helped hundreds of people make better investment decisions. To find out more about his approach and his FREE Newsletter, please visit: www.successful-investment.com.Please also check out forextradingindex.com